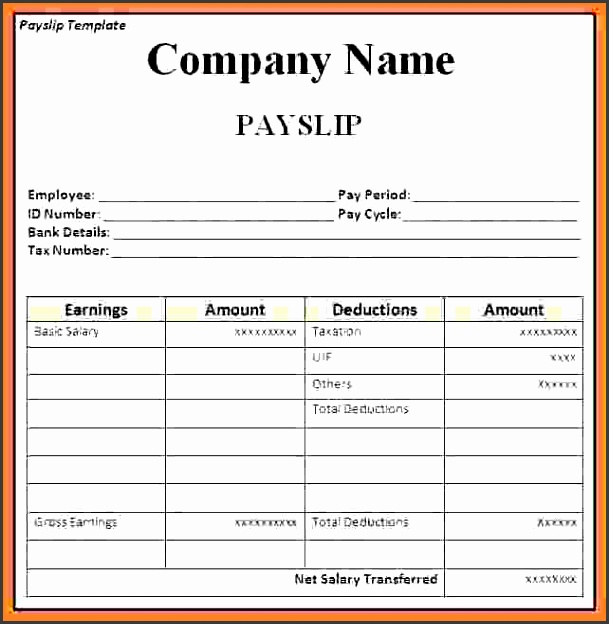

Date of completion and the period for which the payment was made,.Employee data (also information about an employee provided by an employer to ZUS),.However, each pay slip contains key items, which are: The number of items is not influenced by the way in which the pay slip is distributed (e-slip or paper slip), but by the reliefs applied, tax preferences, calculation method, working time, etc.

The pay slip, whatever form it takes, contains a number of items indicating the way in which an employee’s net salary is calculated. Pay slip – what should it contain and how to read it? Providing employees with pay slips is therefore entirely voluntary, and the slips can be produced both in electronic form, so-called e-slips, and in paper. Under the Labour Code, employers are not obliged to do so, but it is possible to provide for such an option in the work regulations or remuneration regulations.

Pay slip – is an employer obliged to issue it?Ī lot of companies prepare monthly pay slips for their employees informing them about how their salaries are calculated. The pay slip informs an employee what the difference between the gross and net monthly salary is. How to read the pay slip correctly and is an employer obliged to issue it?Ī pay slip is a summary of the most important information concerning the components of an employee’s salary, such as any contributions deducted from the pay and any tax deductions or preferences applied. Sample 2020 Forms W-2, W-2AS, W-2GU, and W-2VI revised to correct alignment of the "VOID" and "box 13" checkboxes - 1Ģ020 Forms W-2 Reporting of Qualified Sick Leave Wages and Qualified Family Leave Wages Paid Under P.L.A pay slip, or a salary slip, contains important information about the components of a monthly pay, and includes, among other things, the amount of social security and health insurance contributions deducted. New electronic filing requirements for Forms W-2 - 07-JULY-2023Ģ021 Forms W-2 Reporting of Qualified Sick Leave & Family Leave Wages Paid Under the Families First Coronavirus Response Act, as amended by the American Rescue Plan - 2Ģ021 Form W-2 and the General Instructions for Forms W-2 and W-3 updated for section 9632 of the American Rescue Plan Act of 2021 - 2įaxing request for extension of time to furnish statements to recipients - 0įorm W-2 Reporting of Employee Social Security Tax Deferred under Notice 2020-65 - 2Ģ020 General Instructions for Forms W-2 and W-3 Corrected for Certain Filing Date and Penalty Amount - 1

New electronic filing requirements for correction Form W-2c - 07-JULY-2023

0 kommentar(er)

0 kommentar(er)